President Donald Trump has championed tariffs as his main strategy to revive American manufacturing, reduce the budget deficit, protect domestic industries, and even promote global peace. As both a past and current presidential candidate, Trump has expanded on his tariff agenda, proposing sweeping import taxes — including a 60% tariff on Chinese goods and a 20% tariff on all other imports.

Despite the public’s outcry, there are some benefits to these taxes. Namely: the protection of domestic industries. Tariffs raise the cost of imported goods, making domestic alternatives more appealing and therefore competitive. This can potentially shield U.S. manufacturers from foreign competition, especially in industries like steel, solar panels, vehicles, and aluminum. Another possible advantage is leverage in international negotiations. Tariffs can be used as diplomatic tools to influence foreign policy, such as pressuring Mexico to curb migration flows. For example, Trump threatened to impose a 100% tax on Mexican-made goods to persuade Mexico to limit their migrants on their way to the United States. Tariffs can also be utilized as a peacekeeping measure, suggesting they could deter war by threatening economic penalties. Finally, though tariffs account for a small fraction of federal revenue today, they still contribute billions to the National Treasury. Trump supports a clear shift toward a budget policy that resembles the 19th-century, where tariffs played a more prominent fiscal role in U.S. revenue.

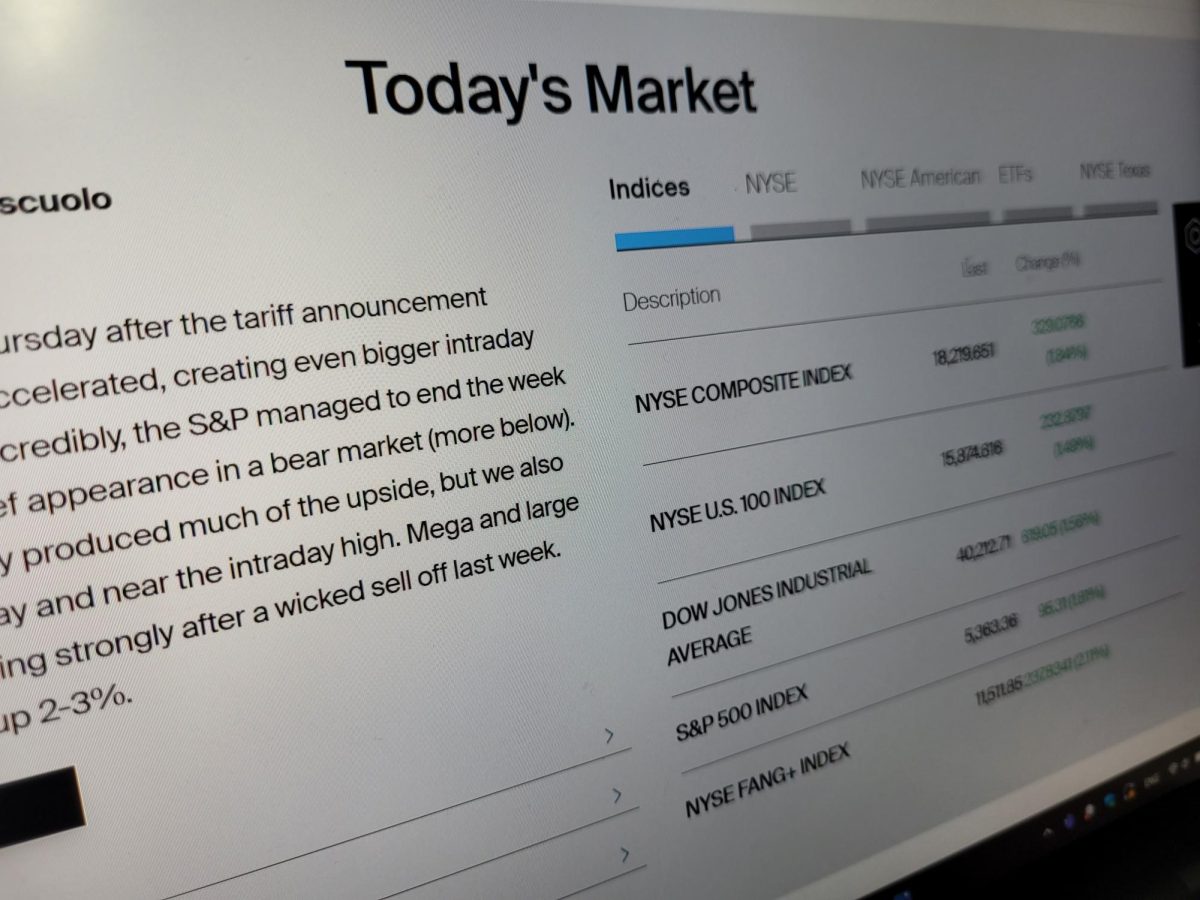

There are drawbacks of Trump’s tariffs to consider as well. To begin, they will inevitably cause higher costs for consumers and businesses. Tariffs function as import taxes, which are paid by U.S. importers and are then passed on to consumers in the form of higher prices. This can lead to increased costs for everyday goods, including groceries, electronics, and clothing. There are also larger possible economic impacts of these tariffs. The Peterson Institute projected that Trump’s new tariffs could reduce U.S. GDP by over 1% by 2026 and raise inflation by 2%. A typical American family could face an estimated $4,000 annual cost due to a universal 20% tariff. This will significantly impact the standard of living for all Americans. We can also expect retaliation from the trade partners we are taxing. The EU and China imposed counter-tariffs targeting U.S. exports such as soybeans, pork, and motorcycles. This disproportionately hurts American farmers and manufacturers alike. Similarly, the disruption the tariffs cause will undermine U.S. trade agreements. Trump’s proposed tariffs risk his current deals, including the US-Mexico-Canada Agreement (USMCA), which allows for tariff-free movement of goods between the two countries. This could strain international relationships and the country’s long-term trade stability.

One thing is certain: tariffs have become one of the most debated topics in American economic and political society. Trump’s aggressive use of tariffs has sparked sharp divisions not just between political parties, but also between businesses, economists, and voters.